(We’re continuing to update this piece on the latest at the end!)

If I had told you last year that GameStop, the retail business that was already struggling even before COVID hampered its plans for rescue, would make headlines in 2021 for a massive stock surge involving Elon Musk, Reddit shitposters, and hedge fund villains, you would’ve laughed at me, and rightly so. But here we are and it’s happening.

Let’s recap a bit. The internet daytraders over on the Wall Street Bets subreddit apparently got a burr up their butts to start pumping money into the flailing GameStop stock, driving it from around $17 at the beginning of the month to over $340 as of this afternoon as I write this. The immediate effect has been to devastate the hedge funds that were short-selling GameStop.

The funds most deeply affected, like Melvin Capital Management, were likely writing uncovered calls for GameStop stock, which is to say, they were betting they’d be able to buy GameStop stock cheaply in the future to cover those calls, which they cannot do without losses now. Melvin’s $12.5B in managed funds was down almost a third and provoked additional rescue investment to combat the short crunch, all seen as a sign by the Reddit daytraders that their guerilla trading is working to defeat whom they see as the bad guys. The situation was compounded today when two of the main hedge funds announced they had covered their calls, which might be true, or it might be an attempt to dissuade continuing buys.

None of this is illegal, mind you, and yes it’s how the stock market has always worked – it’s just some people are just now figuring it out. And they’re currently on Reddit trying to convince each other not to sell or let it all come crashing down. Worth noting is that even if GameStop were a great company to begin with (and it’s not), it isn’t actually benefiting from any of this, since it’s unlikely to have any lasting impact – except for some of the investors who happened to jump in and out at the right time and are now sitting on piles of real money, again egged on by no less than Elon Musk and people on Reddit who’ve been advocating a short squeeze of GameStop since at least 2019.

I am not a professional investment broker, so you should probably not listen to my advice on stock trading. But that also goes for pretty much every other non-expert on the internet, especially anons on a Reddit who may or may not be finding new ways to dupe newbie investors and pump stocks for their own profit. It’s fun to stick it to the worst scum on Wall Street, but do make sure you’re not the dupe left holding the bag when the pump is inevitably over.

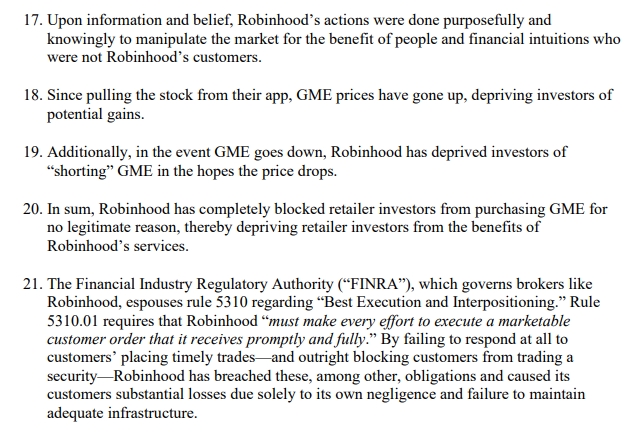

The WSB subreddit is on fire, talking class-action lawsuits and begging Canadians to help.

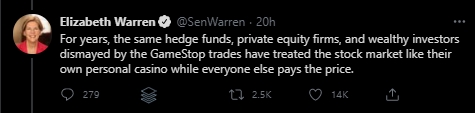

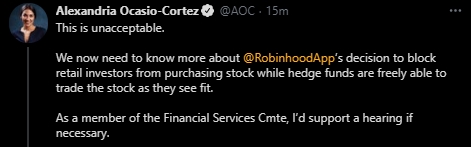

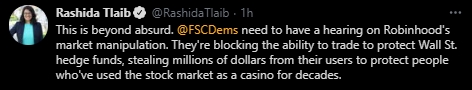

Politicians are getting pissed too.