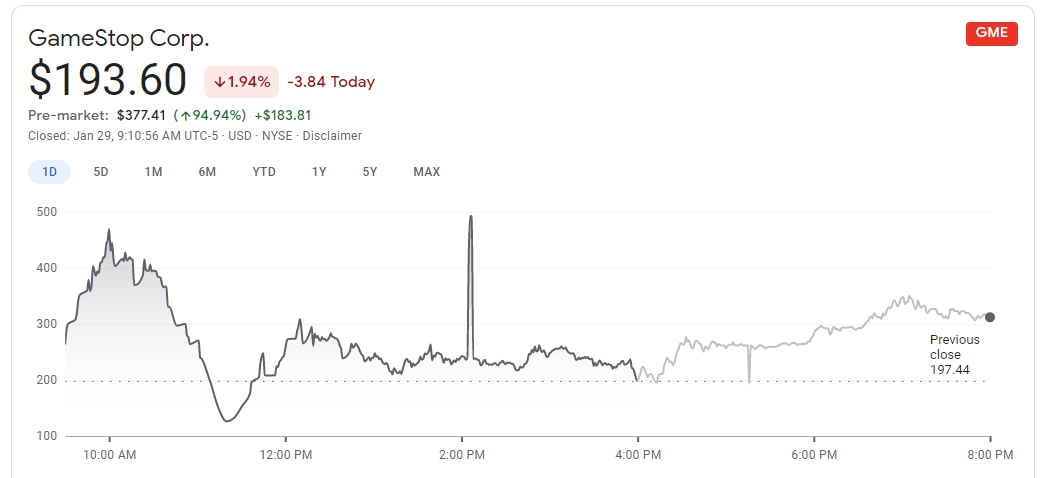

The GME train keeps on a rollin’ here on Friday. As daytraders and retail stock-buyers have been organizing on Reddit to buy GameStop stock and urging each other to “hold the line,” the price of that stock has lurched around all week and been the star of even the mainstream news cycle as politicians rage, pundits scowl, billionaires quake, and shitposters declare victory.

As we noted in our previous coverage, the coordinated mass-buying frenzy devastated the hedge funds that were short-selling GameStop stock, reportedly costing at least one of them (Melvin Capital Management) several billion dollars, which as far as the subreddit is concerned is working as intended, as one of the stated goals of the group is to wreck precisely these types of destructive financial factions. As a side-effect, though, a short list of bajillionaires and people who’ve been advocating a short squeeze of GameStop since at least 2019 are also making bank (in other words, not all the anons on WSB are warriors for populism).

Yesterday, just as the stock was taking off again, several of the trading apps aimed at retail (normal person) stock traders abruptly cut off many services, removing small traders’ ability to purchase stocks like GME but allowing them to sell – and allowing large funds to continue as normal. The anger at the unfairness was palpable across the internet, even generating vocal support from politicians on both sides of the aisle, some of whom pledged congressional hearings and SEC intervention. At least one class-action lawsuit was filed against the Robinhood trading app specifically. While traders speculated that Robinhood was being strong-armed by the very hedge funds that had been exposed, others pointed to the fact that Wall Street clearing entity regulations hampered Robinhood with requirements to cover its clients’ trading risk. (This thread is a marvelous explanation for why you could blame Wall Street incumbents, not Robinhood.)

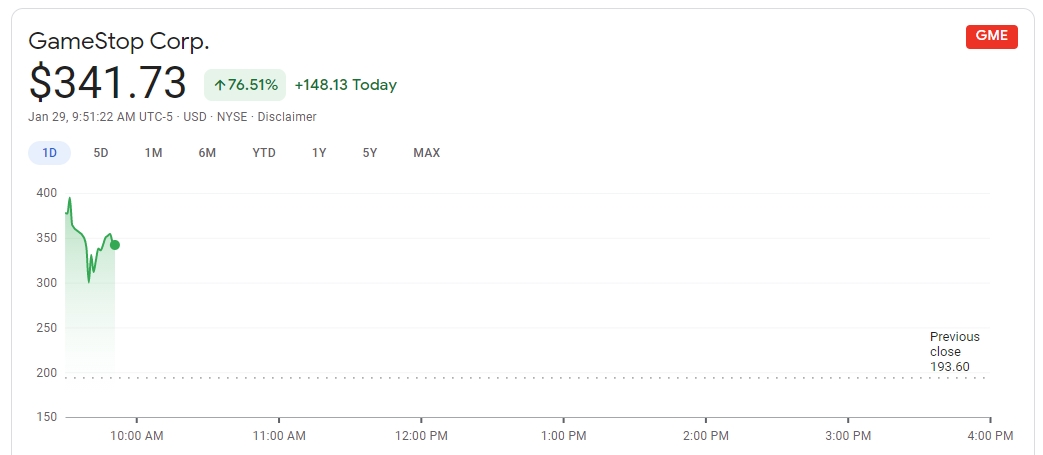

In any case (and adding weight to that theory), as of this morning Robinhood had raised a fresh $1B from investors and “tapped its credit lines with banks” to cover that risk and has resumed trading, but still with tight limits for GameStop (and a dozen other similar stocks) in place, restricting buyers to five shares or 10 options contracts apiece. That’s meant the price is back up again at the start of trading this morning.

If you’re still lost, or just bored at work, Stephen Colbert’s explainer is pretty amusing.

We also found the absolute worst take, for comparison.

https://twitter.com/CopingMAGA/status/1354864967011475456

It can’t last forever, but it’s certainly not over yet. We reiterate to novice traders, be smart.