Earlier this week, we covered the news that Perfect World’s North American branch, and by extension its publishing branch and Cryptic Studios, had been bought by Embracer Group AB and slotted into its Gearbox subsidiary. I won’t say the news was completely out of left field, as PWE has to have been hurting after its two releases in 2020 and 2021 – Torchlight III and Magic Legends, both downgraded from MMO to multiplayer prior to launch – flopped rather miserably, Magic Legends so badly it was canned during beta and prompted layoffs. However, the Embracer/Gearbox move certainly didn’t seem a likely match.

In any case, thanks to the buyout and Embracer’s investor presentation, we’ve learned a bit more about PWE and Cryptic’s MMORPGs.

PWE is still pretty big, in spite of the layoffs. PWE counts 237 employees, 136 of them at Cryptic – that’s after the mass-layoffs following Magic Legends’ demise, however. While we focused on the MMORPGs – Star Trek Online and Neverwinter chief among them – the report also references all of the Perfect World Chinese imports, as well as multiple long-dead titles and the folded MOBA Gigantic.

Neverwinter is PWE’s biggest game by a whole lot. Neverwinter is marked as having accrued $400M from 20M lifetime players, compared to $240M and 6M players from Star Trek Online and $200M and 4M players from Perfect World International (doesn’t this seem way too high?). The Torchlight franchise is bundled together to get to $64M revenue and 5M units sold. Given how poorly Torchlight III did, we presume most of that belongs to the earlier titles. Remnant from the Ashes isn’t an MMORPG, but it apparently racked up $70M in revenue with 3M sales – not shabby for a game that’s basically finished now.

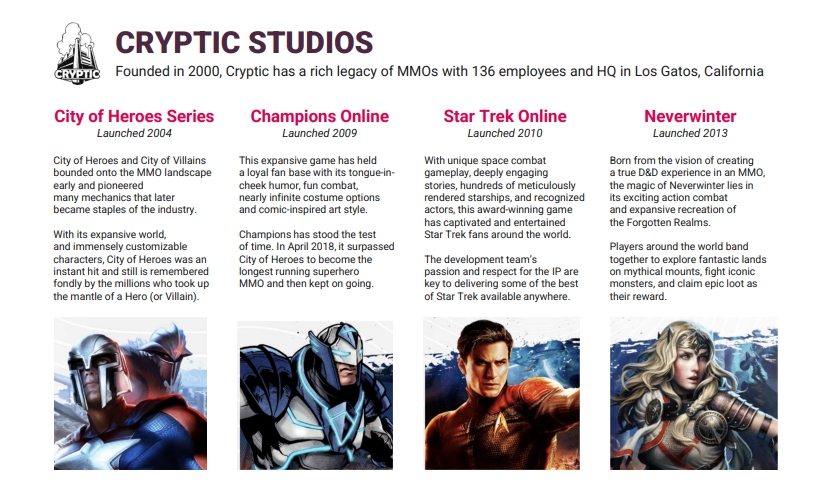

No capes! Champions Online’s revenues and players aren’t listed, but Champs – as well as the City of Heroes franchise, which of course hasn’t belonged to Cryptic in over 14 years – is also mentioned in the historical section. Champions is also included with Gigantic, Hob, and Torchlight as owned IPs.

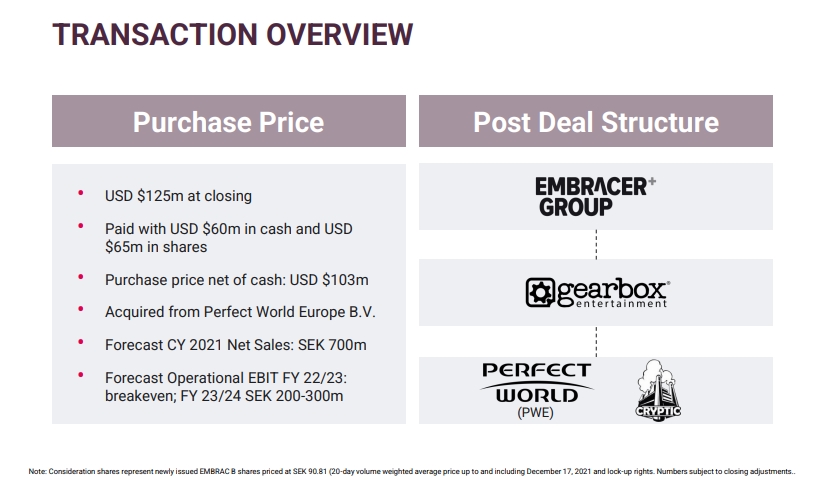

PWE is worth about as much as Albion Online’s Sandbox Interactive. Embracer paid $125M US, about half in cash and half in shares. The new subsidiary is expected see $77M US in net sales this year, “break even” next year, and $22M-$33M US in operational EBIT the year after that.

Why PWE? The last couple of slides talk up PWE’s and Cryptic’s portfolio, uniqueness, and MMO expertise. “The acquisition accelerates Gearbox Entertainment’s mission to

Entertain the World,” it says.