As promised, the US House Financial Services Committee held its hearing on Gamestonk yesterday, and to read some of the coverage, you’d think the most interesting thing was the gaming chair and cat memes of one of the people being sued for market manipulation. But of course, that’s not the real story.

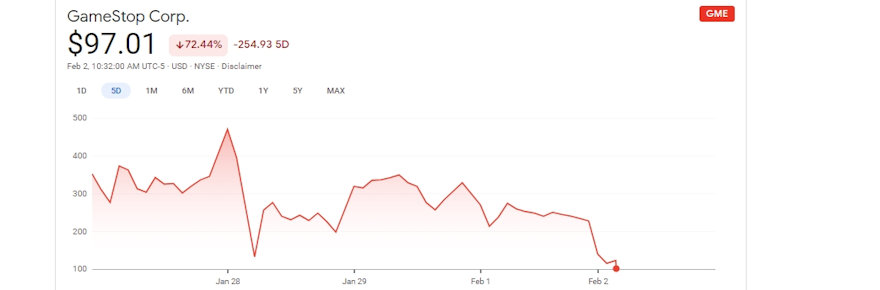

Readers will recall that celebrity investors and retail stock-traders pumped the floundering Gamestop’s stock value in January in an ostensible attempt to squeeze short-selling hedge funds. As we noted earlier this week, while some hedge funds lost substantial sums of money, none actually went under, and some actually made money on the game – to say nothing of the small-peanuts traders who got swept up in the “diamond hands” rhetoric on Reddit and lost their own sums when the stock inevitably came crashing back down.

The majority of the hearing focused on Robinhood, one of the trading apps that stymied retail traders in the middle of the pump, and Citadel, the company that actually executes Robinhood’s trades and had been accused of meddling in trading to limit losses. But Keith Gill aka DeepFuckingValue on Reddit aka Roaring Kitty on YouTube scored the headlines as he was one of the pre-Gamestonk Gamestop investors who made fortunes from promoting the stock last month – his to the tune of $48M (though apparently he cashed out “only” $13M on his $50K investment).

Gill is currently a co-defendant in a class-action lawsuit filed on behalf of investors that accuses him of “deceitful and manipulative conduct” and violating securities law. “He caused enormous losses not only to those who bought option contracts, but also to those who fell for Gill’s act and bought GameStop stock during the market frenzy at greatly inflated prices,” the suit alleges.

Though Gill told the House committee he was “not an institutional investor, nor […] a hedge fund,” he is in fact a licensed securities broker who works for MassMutual – or rather, worked for MassMutual. That company, a life insurance and fund-management financial corporation, is also named as a defendant in the suit, which claims it had “legal and regulatory obligations to supervise Gill to prevent this very conduct.”

“The idea that I use social media to promote Gamestop stock to unwitting investors and influence the market is preposterous,” Gill argued at the hearing. “My post did not cause the movement of billions of dollars into Gamestop shares. It is tragic that some people lost money, and my heart goes out to them. But what happened in January just demonstrates again that investing in public securities is extremely risky.”

The Reddit-driven GameStop stock spike isn’t going to end well

The Reddit-driven GameStop stock spike isn’t going to end well

With some trading restrictions lifted, GameStop stock is taking off again

With some trading restrictions lifted, GameStop stock is taking off again

MMO Business Roundup: Gamestonk is tipping toward over as shares dip below $100 a pop

MMO Business Roundup: Gamestonk is tipping toward over as shares dip below $100 a pop

Gamestonk’s gamified guerilla trading made losers of both the good and bad guys

Gamestonk’s gamified guerilla trading made losers of both the good and bad guys

MMO Business Roundup: CDPR’s misery, Gamestonk revives, Riot’s Game Changers

MMO Business Roundup: CDPR’s misery, Gamestonk revives, Riot’s Game Changers

Massively Uplifting: Gamestonk, gorillas, and giving in MMOs

Massively Uplifting: Gamestonk, gorillas, and giving in MMOs

Subreddit founder who started the 2021 Gamestonk craze sues Reddit over his ouster

Subreddit founder who started the 2021 Gamestonk craze sues Reddit over his ouster