It seems like a long time ago, but just a few weeks back, the mainstream news cycle was absolutely obsessed with Gamestop thanks to celebrity investors and retail stock-buyers on Reddit pumping up the stock in a successful bid to damage hedge funds that were writing uncovered calls for it. During the melee, trading apps exposed weaknesses, retail investors were stifled, government representatives got involved, lawsuits were filed, and the short-sellers got short-squeezed. Short-squozed. Short-squozen.

But as we noted from the start, the fallout from the pump and dump was going to be heartbreaking, and now the internet is compiling lists of both victims who lost money and winners you really didn’t want winning. For example, The Wall Street Journal has a piece up on some of the amateurs who got swept up in the “to the moon!” rhetoric on Reddit. The most depressing example is the 20-something who apparently took out a $20,000 loan to buy the stock at $234. The New York Times and Forbes chronicled multiple people who lost even more, which rather outweighs the puff pieces about how a cute kid made three grand.

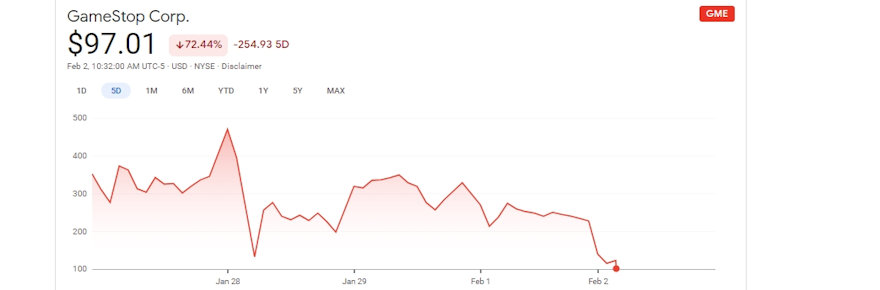

As readers know, the stock has fallen from its peak of nearly $500 per share value down to a tenth of that, where it sits now, meaning many of the people who bought it late or who didn’t sell early are screwed – and they weren’t all doing it to fight the hedge funds, which are already back to business as usual. And that’s just Gamestop; there were multiple other stocks being pumped in similar ways, like Blackberry and AMC.

Meanwhile, some of the people who’d been sitting on Gamestop stock for a long time while it was worthless suddenly made megabucks off it once folks like Elon Musk and Reddit anons started promoting it, and that includes the trading apps and some hedge funds themselves. In fact, one of the early proponents on Reddit – Keith “Roaring Kitty” Gill, who turned his $53,000 2019 GME investment into $48M last month – is set to testify before the US House Financial Services Committee on Thursday, February 18th. Gill, it’s worth noting, is a a licensed securities broker who worked for MassMutual, a sharp reminder that a lot of the “anons” on the WallStreetBets sub are not amateurs whose chief goal is helping the proletariat Fight The System, so following advice and bandwagons from the sub may not be in your best interests.

If you’re hungry for more while waiting for the government hearings, The Verge has a really interesting (that’s not sarcasm) interview up with CNBC business journalist Jon Fortt; during the first half, which is specific to the Gamestonk scenario, they discuss the “Fight Club fanfiction” of taking down the hedge funds, the scams and malice that can lurk in the anonymity of message boards about stocks, the very real and justified anger people have toward Wall Street following the 2008 financial crisis, and the fact that hedge funds that weren’t shorting GME still made bank off all this in spite of some retail traders’ willingness to lose money to bring them down. The most provocative bit in the interview comes when Fortt rejects the idea that Gamestonk represents an advance in democratizing finance (which he supports overall) and argues that Reddit and trading apps dovetail into a form of not-necessarily-positive gamification.

“Investing is not Candy Crush, right?” he says. “It doesn’t work that way. And if there’s a system set up that makes it feel like that, that might just be bad for retail investors.”

The Reddit-driven GameStop stock spike isn’t going to end well

The Reddit-driven GameStop stock spike isn’t going to end well

With some trading restrictions lifted, GameStop stock is taking off again

With some trading restrictions lifted, GameStop stock is taking off again

MMO Business Roundup: Gamestonk is tipping toward over as shares dip below $100 a pop

MMO Business Roundup: Gamestonk is tipping toward over as shares dip below $100 a pop

House financial services committee investigates Gamestonk as investors sue Reddit ‘agitator’

House financial services committee investigates Gamestonk as investors sue Reddit ‘agitator’

MMO Business Roundup: CDPR’s misery, Gamestonk revives, Riot’s Game Changers

MMO Business Roundup: CDPR’s misery, Gamestonk revives, Riot’s Game Changers

Massively Uplifting: Gamestonk, gorillas, and giving in MMOs

Massively Uplifting: Gamestonk, gorillas, and giving in MMOs

Subreddit founder who started the 2021 Gamestonk craze sues Reddit over his ouster

Subreddit founder who started the 2021 Gamestonk craze sues Reddit over his ouster