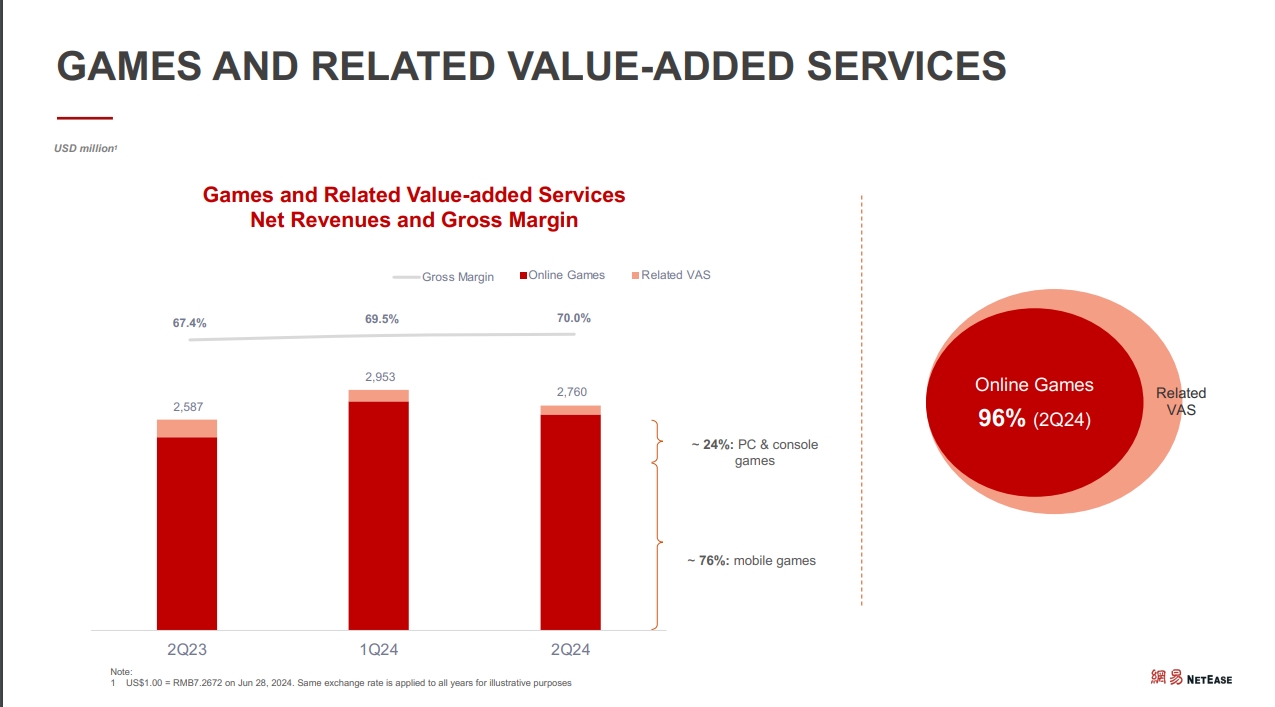

We haven’t often covered NetEase’s financial reports, but as the company continues to chuck out (and sunset) new multiplayer games and MMOs, it seems time to rectify that. The Chinese megacorp released its Q2 2024 financials at the end of August, and on the surface, it wasn’t dreadful news: The company saw a revenue dip of 5.1% since Q1 but a bump of 6.1% since Q2 2023 (a dip of 6.5% and a boost of 6.7%, respectively, just in games specifically). The main problem? It missed expectations, one of multiple Chinese tech firms to do so this quarter, hammering the Hong Kong stock market.

Indeed, following the quarterly announcement, the company’s stock took a sharp nosedive and hasn’t recovered; just in the last two weeks, NetEase (NTES) has lost around 16% of its value. In the last half year, it’s down 27%. (Analysts still consider it a bargain stock, but the dip isn’t pretty.)

Moreover, as Bloomberg explains, Chinese companies like NetEase and Tencent are eyeing partial investment pullouts in Japan, the world’s third-largest games market. Both had pushed hard into buying Japanese studios to offset stagnation in the Chinese gaming market, but now NetEase is allegedly slashing its spending in the region, rescinding “at least several funding commitments for new games,” and shuttering studios and laying off workers in Japan, all following what the paper characterized as an expansion without “much to show for it.” (NetEase did not comment on the studio Bloomberg’s sources said is closing, saying that it’s making “necessary adjustments to reflect market conditions.”)

All of this is notable not just for existing MMO players but for folks who want to play MMOs a few years from now. That’s because NetEase has publicly funded or picked up a long list of studios cranking out MMOs, including Worlds Untold, BulletFarm, Second Dinner (Marvel Snap), Craig Morrison’s cozy crime MMO, Greg Street’s Ghost, Rich Vogel’s T-Minus Zero, Jack Emmert’s Warhammer MMO, and on and on. Worth keeping an eye on.