We’ve simply got to stop meeting like this exactly every three months. Yes, it’s time for another round of Activision-Blizzard dissembling in the form of the company’s investor report and conference call. Welcome to Q4 2020! It’s been a weird couple of years for the company as 2019 saw mass layoffs, the Blitzchung boycott, a weak BlizzCon, and plunging YOY revenues for five straight quarters in May 2019, August 2019, November 2019, February 2020, and May 2020. Q1 2020’s revenue drop was very slight and close to flattening, and then in Q2, revenues for the company were up for the first time in six quarters, largely due to COVID-19 lockdowns. Q3 saw those revenues hold steady.

Revenues in Q4, as it happens, are up again – 17% in fact, a better-than-expected result.

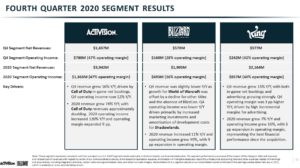

“For the year ended December 31, 2020, Activision Blizzard’s net revenues presented in accordance with GAAP were $8.09 billion, as compared with $6.49 billion for 2019. GAAP net revenues from digital channels were $6.66 billion. GAAP operating margin was 34%. GAAP earnings per diluted share were $2.82, as compared with $1.95 for 2019. On a non-GAAP basis, Activision Blizzard’s operating margin was 39% and earnings per diluted share were $3.21, as compared with $2.31 for 2019.

“For the quarter ended December 31, 2020, Activision Blizzard’s net revenues presented in accordance with GAAP were $2.41 billion, as compared with $1.99 billion for the fourth quarter of 2019. GAAP net revenues from digital channels were $1.87 billion. GAAP operating margin was 25%. GAAP earnings per diluted share were $0.65, as compared with $0.68 for the fourth quarter of 2019. On a non-GAAP basis, Activision Blizzard’s operating margin was 31% and earnings per diluted share were $0.76, as compared with $0.62 for the fourth quarter of 2019.”

Acti-Blizz attributes a lot of the results to Call of Duty, World of Warcraft, and Candy Crush as usual and talks up growth in 2022+.

As for Blizzard specifically, it’s a good thing WoW is doing well because WoW’s numbers are up thanks to Classic and Shadowlands even as Blizzard’s overall MAUs keep on dropping and the press release doesn’t even namedrop Hearthstone, Overwatch, or Diablo III/IV.

To put that in context, Blizzard has lost almost a quarter of its overall playerbase in three years, as measured by Blizzard’s own preferred monthly active user count.

38M in Q1 2018

37M in Q2 2018

37M in Q3 2018 (BFA)

35M in Q4 2018 (mass layoffs)

32M in Q1 2019

32M in Q2 2019

33M in Q3 2019 (WoW Classic)

32M in Q4 2019 (Blitzchung)

32M in Q1 2020 (COVID-19)

32M in Q2 2020 (COVID-19)

30M in Q3 2020 (COVID-19)

29M in Q4 2020 (this quarter)

We’ll be updating with the important-to-us bits from the conference call below as it rolls on.

• Kotick teases Diablo 4 a bit, saying it’s “on the horizon.” Overwatch 2 too. And he promises “more frequent premium content” for the Warcraft franchise.

• Activision says Classic helped buffer WoW between expansions and is suggesting the game and franchise will expand to “more platforms than ever before.” (Not sure what this means – hoping an analyst asks about this. The company did spend a chunk of the Blizzard section vaguely talking up mobile.)

• Activision is talking up reach and subs for WoW and Shadowlands, saying net bookings were up 40% since this time last year, its highest level in almost 10 years.

• Diablo Immortal is apparently still on track to launch this year, though it sounds like it’ll be the tail end of the year at best (the company isn’t incorporating revenues from the game in its 2021 outlook).

• Overwatch 2 is still be worked on as one of the multiple 2022+ pipeline titles.

• Blizzard revenue by itself fell to $579M, which Blizzard attributes to a decline in non-WoW games and the cancelation of BlizzCon. But revs were still up 11% for the year.

• Diablo IV and Overwatch 2 are NOT coming in 2021.

• Activision is saying that in some of its more social titles (like WoW), player engagement has stayed high even as COVID lockdowns are reduced.

• Another hint about upcoming “remastered content” – presumably a reference to Diablo II.

• J. Allen Brack is asked about WoW growth and content. He talks about how Classic and Retail are very different playerbases. They’re very happy with Shadowlands’ quality and numbers and the “momentum” of the engagement is still up a few months past launch. Brack basically says Blizzard is addressing both playerbases and will have more to share (BlizzConline is coming, after all). Nothing concrete in here at all.