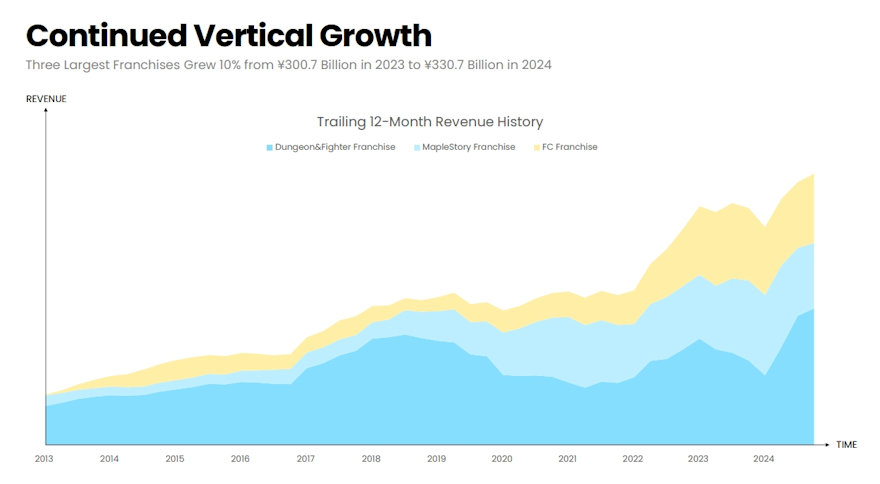

Ladies and gentlebeings, I give you the latest contender for Mystery Chart of 2025! It’s Nexon’s growth chart for Q4 2024, which seems to be missing some important numbers over on ye olde “revenue” axis!

Yeah, you can figure it out if you make some assumptions, but ugggg. This is not the first time Nexon has played fast and loose with the revenue axis on its financial growth charts; here’s one from 2021 where the company went to a lot of trouble to sketch in a cute monkey with a banana and a gingerbread man but neglected to actually put any numbers on the revenue axis. Whoopsie!

Anyway, Nexon had little reason to be weird about this because it dropped another decent quarter on investors, with revenues of ¥446.2B – up another 5% compared to Q4 2023, owing heavily to the MapleStory franchise, which made up for shortfalls in soccer game FC and The First Descendant. Those revenues are lower than expected, however. Heads-up that the board of directors is pursuing an aggressive stock buyback.

Over the course of the rest of the year, Nexon says it expects MapleStory and FC to hold steady as it works with Tencent to bolster Dungeon&Fighter in China. It also says MapleStory Worlds “deliver[ed] better-than-expected results” with its launch, which “bodes well for a regional expansion into Europe, which began in January, and Southeast Asia, which is scheduled for this year.” Finally, the company slides talked up Mabinogi, Mabinogi Mobile (coming in March), Mabinogi Eternity (the UE5 upgrade), The First Descendant (planning S2P2 in March), and The Finals – though Nexon admits it’s expecting a YOY “revenue decline” there.