Activision-Blizzard has not had the best year. In February, the company saw record-high revenues and promptly laid off 800 employees, leading to widespread condemnation. In May, we confirmed the company’s revenue spike was indeed a bubble bursting, as the company’s revenues absolutely plummeted. By August, the company was looking at still more revenue dips while talking up its new priorities; while World of Warcraft subs were up ahead of the launch of WoW Classic as expected, monthly active users (MAUs) for Blizz were down from 38M in Q1 of 2018 to 32M in Q2 of 2019.

So here we are in Q3 of 2019, July, August, and September. The date range here is notable because it does include the entirety of the WoW Classic launch, but it doesn’t include the influence of the Hong Kong drama in October or BlizzCon impact in November, good or bad. Ready?

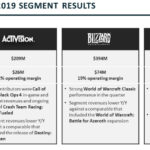

So Activision-Blizzard had another rough quarter, with revenues down once again, this time down 16% compared to the same quarter last year. Even so, the company characterizes it as a better-than-expected quarter thanks to COD and WoW.

“For the quarter ended September 30, 2019, Activision Blizzard’s net revenues presented in accordance with GAAP were $1.28 billion, as compared with $1.51 billion for the third quarter of 2018. GAAP net revenues from digital channels were $1.01 billion. GAAP operating margin was 19%. GAAP earnings per diluted share were $0.26, as compared with $0.34 for the third quarter of 2018.”

“For the quarter ended September 30, 2019, Activision Blizzard’s net bookingsB were $1.21 billion, compared with $1.66 billion for the third quarter of 2018. Net bookingsB from digital channels were $0.98 billion, as compared with $1.44 billion for the third quarter of 2018. In-game net bookingsC were $0.71 billion.”

“Recent launches have enabled significant growth in the size of our audiences for our Call of Duty and World of Warcraft franchises,” CEO Bobby Kotick says. “As we introduce mobile and free-to-play games based on our franchises we believe we can increase audience size, engagement and monetization across our wholly owned franchises. With a strong content pipeline and momentum in mobile, esports and advertising, we are confident we will remain a leader in connecting and engaging the world through epic entertainment.”

There’s a bit of good news for MMO fans in here, however, as Blizzard’s overall MAUs added another 1M players in the quarter, increasing from 32M to 33M. That’s thanks to WoW Classic, which the company says “drove the biggest quarterly increase to subscription plans in franchise history, in both the West and East.” (Again, the fact that Blizzard intentionally obscures playerbase size across all of its games makes it hard to figure out how well Classic really did; we do know that Blizz MAUs were 37M in Q3 2018, the quarter Battle for Azeroth came out.)

Also worth noting here is that SuperData’s revenue rankings definitely reflected a big surge for World of Warcraft in the west in August, but by September that surge appeared to be mostly over as WoW had already dropped back down to its “normal” spot in the bottom half of the top 10. Then again, that report coincided with the news that both console and PC spending is down significantly year over year. Either way, we suspect SuperData’s October and November reports – and the February Acti-Blizz investor call – will make for interesting reporting indeed.

In response to an analyst’s question, the company did point out the importance of WoW Classic’s reach in an “off” year for WoW. After-hours stock trading has shown the company dropping several points, but of course it’s nowhere near as bad as earlier this year.

Another analyst asked specifically about WoW Classic retention. Blizzard dodged and instead pointed out that it intentionally set up the sub so that players can go between the two games.