NCsoft is not having the best couple of quarters. According to the company’s first quarter 2021 report, its revenue has fallen 30% compared to this quarter last year, which was clearly buoyed a bit by last year’s lockdowns and massive mobile launches in the preceding period.

How about some good news, then? Guild Wars 2’s revenues have increased 25% this quarter compared to the same quarter in 2020. We’ll see whether that trend continues after the poorly received final episode of the Icebrood Saga or End of Dragons can double-down on the gains; neither 2019 nor 2020 could top the game’s 2018 revenues.

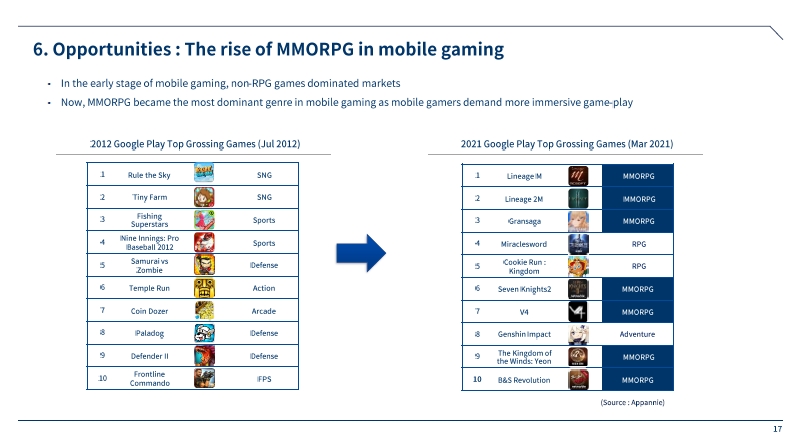

Aion had an even better showing, improving its revenues by more than double since Q1 2020, which bought it in line with its 2019 numbers. In fact, it appears most of the losses are coming from the mobile side of the company; whereas “legacy PC game sales” saw a 6% increase, mobile has dropped off dramatically. According to NCsoft, the “new gamers” it picked up on mobile during the pandemic “have tendency to have multiplayer experiences and the rise of MMORPG is expected to be continued going forward.” The chart is worth a look to illustrate how mobile gaming has shifted around overseas.

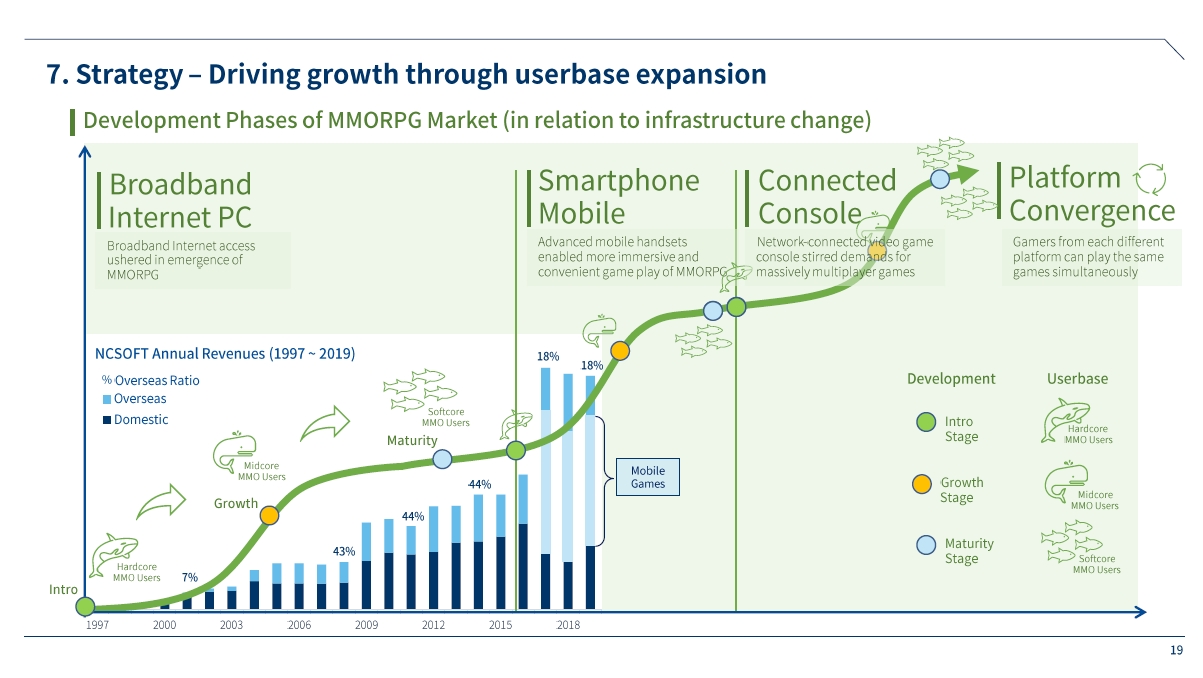

You know what, so is this one. Look, we’re all sharks and whales and fishies!

MMO Fallout blessedly listened to the investor call and pulled out some noteworthy bits, including the news that Blade & Soul 2’s would-be playerbase is trending older than Blade & Soul’s – GenX rather than Millennials. The company also pledged that Lineage Eternal aka Project TL is its priority, with still more tests planned and a console release on deck.