It’s time for another round of Activision-Blizzard financials as today covers Q3 2020. It’s been a weird couple of years for the company as 2019 saw mass layoffs, the Blitzchung boycott, a weak BlizzCon, and plunging YOY revenues for five straight quarters in May 2019, August 2019, November 2019, February 2020, and May 2020. Q1 2020’s revenue drop was very slight and close to flattening, and then in Q2, revenues for the company were up for the first time in six quarters, largely due to COVID-19 lockdowns.

Of course, at the time, we had only just found out that BlizzCon was canceled, and we didn’t yet know that World of Warcraft Shadowlands was going to be delayed. The latter has already been rectified, of course; the big news that Shadowlands is now launching November 23rd (ahead of the holiday shopping season) conveniently dropped a few hours ago, perfectly positioned to make investors happy.

And as it happens, overall Acti-Blizz revenues for Q3 held steady, improving over 2019’s Q3 and inching up just a tick since last quarter’s $1.93 billion count. Blizzard by itself saw its revenues improve 4% year-over-year, in fact.

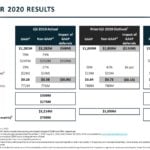

“For the quarter ended September 30, 2020, Activision Blizzard’s net revenues presented in accordance with GAAP were $1.95 billion, as compared with $1.28 billion for the third quarter of 2019. GAAP net revenues from digital channels were $1.75 billion, as compared with $1.01 billion for the third quarter of 2019. GAAP operating margin was 40%. GAAP earnings per diluted share were $0.78, as compared with $0.26 for the third quarter of 2019. For the quarter ended September 30, 2020, on a non-GAAP basis, Activision Blizzard’s operating margin was 44% and earnings per diluted share were $0.88, as compared with $0.38 for the third quarter of 2019. For the quarter ended September 30, 2020, operating cash flow was $196 million. For the trailing twelve-month period, operating cash flow was $2.03 billion.”

It’s not all great news; MAUs (monthly active users) across all of Blizzard’s games fell by 2 million over the last quarter. Here’s the chronology of MAUs over the last couple of years so you can see how far the tally has fallen:

38M in Q1 2018

37M in Q2 2018

37M in Q3 2018 (BFA)

35M in Q4 2018 (mass layoffs)

32M in Q1 2019

32M in Q2 2019

33M in Q3 2019 (WoW Classic)

32M in Q4 2019 (Blitzchung)

32M in Q1 2020 (COVID-19)

32M in Q2 2020 (COVID-19)

30M in Q3 2020 (this quarter)

In other words, Blizzard has lost 21% of its overall playerbase in the last three years. According to the press release, WoW’s MAUs are “stable” and 10M of the remaining total of 30M belong specifically to Overwatch, so it’s not entirely clear which games have bled players.

“World of Warcraft MAUs were stable year-over-year,” the press release says. “Anticipation continues to build for Shadowlands, the next expansion for modern World of Warcraft, ahead of its November 23 launch. World of Warcraft franchise engagement is at its highest level for this stage ahead of an expansion in a decade, with Shadowlands presales well ahead of any prior expansion.” I know, I know, “engagement.” Obligatory:

Incidentally, Activision-Blizzard’s Bobby Kotick told GamesBeat that “the company needs to hire more than 2,000 people to meet its production demands,” in addition to the 10,000 the company has now. Gee, if only it hadn’t laid off 800 people last year or all the staff in Versailles a few weeks ago. Wild.

We’ll be updating with the important bits from the conference call below once it’s started at 4:30 p.m. EDT.

- Kotick’s slide says WoW is expected to generate over $1B in net bookings this year and that there are “multiple products” in the Diablo franchise pipeline.

- Kotick repeats the same line he’s given for several quarters now, mentioning that the WoW subscriber base doubled after Classic but not mentioning that it also appeared to drop back to normal a few months later. The investor call seems to suggest that WoW is back up to those levels again now thanks to Shadowlands and the pre-patch. We don’t actually know the balance of Retail to Classic; last quarter, Blizzard dodged a direct question about that.

- Kotick is suggesting there will be “more frequent major content launches” for both WoW Retail and Classic. No details given.

- Pre-sales are “highest [Blizzard has] seen” for any WoW expansion; the company repeats the same line as last quarter about engagement being at its highest point (“unprecedented engagement trends”).

- Diablo Immortal will “soon enter external regional testing” – another line the company has been repeating for several quarters now. Last quarter, Blizzard dodged a question about the testing plan. No details here either.

- $411M of the overall Acti-Blizz revenues are attributed directly to Blizzard, a revenue growth rate of 4% year-over-year “driven by another strong quarter of growth for World of Warcraft.”

- J. Allen Brack was specifically asked about the WoW subscriber/playerbase expectations for Shadowlands and the trajectory heading into 2021. As usual, he gave what sounded like a a prepared statement about the new launch date and excitement and quality and feedback and the prepatch and new-player experience… and really nothing to do with subscriber numbers, apart from once again touching on the Retail/Classic sides being one playerbase. (He repeats this every quarter while dodging these questions. It’s a whole thing.)

- Brack does say that the teams plan to expand the development teams and “even more content” for the two halves of the game, which… I mean, I sure hope so? What else would they even do? He also hints at expanding the franchise, which is so vague it could mean anything:

“We think of Warcraft as a huge franchise, and WoW is only a part of that. We’re always exploring how to express Warcraft with new experiences, and we’ve seen a lot of opportunity for growth there in 2021 and beyond.”

Let the speculation begin.