Welcome back to our inevitable coverage of Activision-Blizzard’s quarterly financials: Today’s edition sums up Q4’s results, comprising October, November, and December 2022. Let’s break it down, first with ABK and then with Blizzard itself.

Activision-Blizzard

Activision-Blizzard on the whole saw a small jump in quarter-over-quarter revenues. However, annual revenues were down overall in 2022 compared to 2021. In the press release, CEO Bobby Kotick pivots to touting “record quarterly net bookings,” though of course it’s not a record quarter for revenue.

“For the year ended December 31, 2022, Activision Blizzard’s net revenues presented in accordance with GAAP were $7.53 billion, as compared with $8.80 billion for 2021. GAAP net revenues from digital channels were $6.63 billion. […] For the quarter ended December 31, 2022, Activision Blizzard’s net revenues presented in accordance with GAAP were $2.33 billion, as compared with $2.16 billion for the fourth quarter of 2021.”

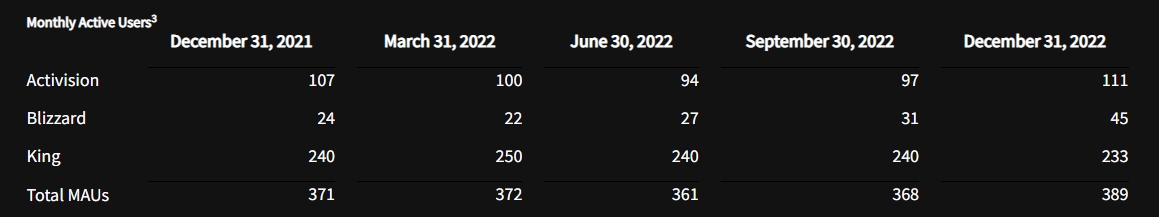

Overall ABK MAUs (monthly active users) increased from 368M to 389M since last quarter; the last time ABK MAUs were this high was Q3 2021. As expected, the bump in Activision-specific revenue was driven by Call of Duty: Modern Warfare II, which ABK says “delivered the highest opening-quarter sell-through in franchise history” owing in large part to Steam, PC, and the Asia-Pacific region. CoD Warzone and CoD mobile are also major contributors.

King – the K in ABK – often provides the only good news in these reports, and indeed it saw revenue up another 6% year over year thanks to Candy Crush, though ABK complains of a “challenging backdrop for mobile games” to explain its Q4 revenue dip.

ABK Q3-22: $1.78B

ABK Q2-22: $1.64B

ABK Q1-22: $1.77B

ABK Q4-21: $2.16B

ABK Q3-21: $2.07B

ABK Q2-21: $2.30B

ABK Q1-21: $2.28B

ABK Q4-20: $2.41B

ABK 2021: $8.80B

ABK 2020: $8.09B

Blizzard Q3-22: $543M

Blizzard Q2-22: $401M

Blizzard Q1-22: $274M

Blizzard Q4-21: $419M

Blizzard Q3-21: $493M

Blizzard Q2-21: $433M

Blizzard Q1-21: $483M

Blizzard Q4-20: $579M

Blizzard 2021: $1.827B

Blizzard 2020: $1.905B

Blizz MAUs Q3-22: 31M

Blizz MAUs Q2-22: 27M

Blizz MAUs Q1-22: 22M

Blizz MAUs Q4-21: 24M

Blizz MAUs Q3-21: 26M

Blizz MAUS Q2-21: 26M

Blizz MAUs Q1-21: 27M

Blizz MAUs Q4-20: 29M

Blizz MAUs Q1-19: 32M

Blizz MAUs Q1-18: 38M

Blizzard Entertainment

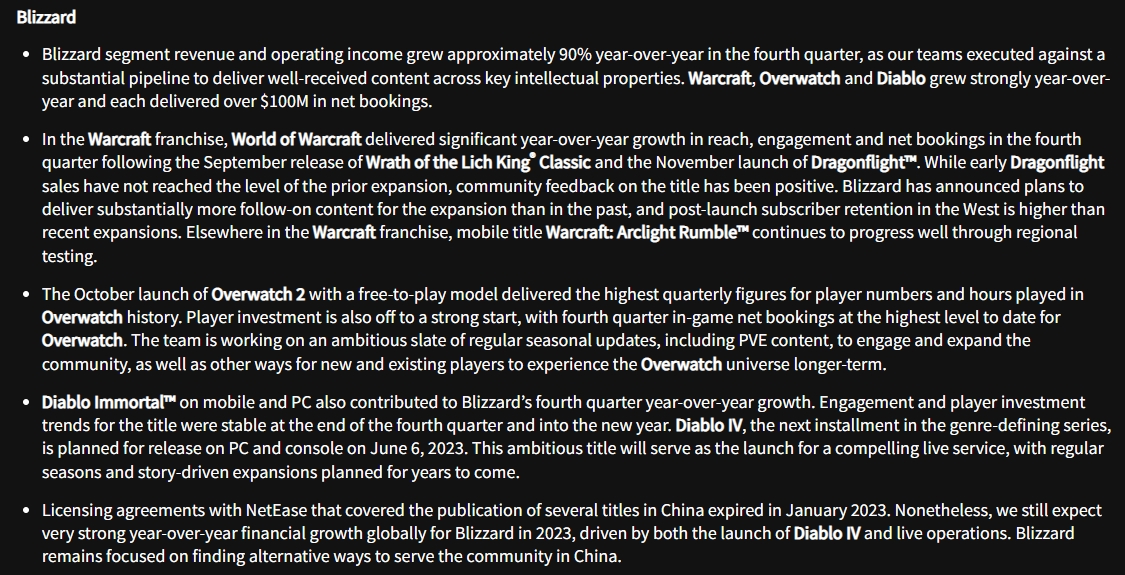

Blizzard itself, of course, was already riding high in Q3 of 2022, having launched Diablo Immortal and Wrath Classic and turning around its collapsing MAUs for the first time in several years. Q4 is more of the same and then some, owing to the launch of Overwatch 2 and World of Warcraft Dragonflight: Revenue nearly doubled to $794M compared to the much weaker Q4 2021. WoW players might want to read the fine print, however, in regard to weaker Dragonflight sales and player retention.

“In the Warcraft franchise, World of Warcraft delivered significant year-over-year growth in reach, engagement and net bookings in the fourth quarter following the September release of Wrath of the Lich King® Classic and the November launch of Dragonflight™. While early Dragonflight sales have not reached the level of the prior expansion, community feedback on the title has been positive. Blizzard has announced plans to deliver substantially more follow-on content for the expansion than in the past, and post-launch subscriber retention in the West is higher than recent expansions. Elsewhere in the Warcraft franchise, mobile title Warcraft: Arclight Rumble™ continues to progress well through regional testing.”

The company further says that Overwatch 2 “delivered the highest quarterly figures for player numbers and hours played in Overwatch history” and that Diablo Immortal engagement is “stable.”

Perhaps the best news for Blizzard proper here is that its MAUs soared to 45M – that’s the highest player population the company has counted since 2018, when it first began reporting company-wide MAUs. It’s also doubled since the low point of 22M at the start of 2022. Bizarrely, the studio’s Q4 2022 MAUs are buried in a chart at the bottom of the press release rather than trumpeted in the segment brag sheet.

ABK does tangentially acknowledge the loss of almost the entire Blizzard Chinese playerbase following the sunset of all Blizzard titles excepting Diablo Immortal in January. Don’t expect to see those losses reflected in MAUs until Q1 or more fully in Q2 2023, however. That, plus the potential for F2P falloff from OW2, might also be why Blizzard isn’t crowing about that massive MAU spike, knowing the figure won’t hold long. Still, it’s a burst of good news for a company whose pipeline had spent years dry and had the desiccated MAUs to match.

“Licensing agreements with NetEase that covered the publication of several titles in China expired in January 2023. Nonetheless, we still expect very strong year-over-year financial growth globally for Blizzard in 2023, driven by both the launch of Diablo IV and live operations. Blizzard remains focused on finding alternative ways to serve the community in China.”

Our running MAU tally:

38M in Q1 2018

37M in Q2 2018

37M in Q3 2018 (BFA)

35M in Q4 2018 (mass layoffs)

32M in Q1 2019

32M in Q2 2019

33M in Q3 2019 (WoW Classic)

32M in Q4 2019 (Blitzchung)

32M in Q1 2020 (COVID-19)

32M in Q2 2020 (COVID-19)

30M in Q3 2020 (COVID-19)

29M in Q4 2020 (COVID-19, Shadowlands)

27M in Q1 2021

26M in Q2 2021 (TBC Classic, WoW 9.1)

26M in Q3 2021 (D2R, lawsuits)

24M in Q4 2021 (Lawsuits, drought)

22M in Q1 2022 (Lawsuits, drought)

27M in Q2 2022 (Diablo Immortal)

31M in Q3 2022 (DI China, Wrath Classic)

45M in Q4 2022 (Overwatch 2, Dragonflight)

As always, we note here that Blizzard intentionally reports MAUs this way to obfuscate which games are gaining and losing players, and traditionally it notes whenever a specific game has increased in MAUs.

Activision-Blizzard hasn’t been “hosting a conference call, issuing an earnings presentation, or providing financial guidance” pending the Microsoft buyout, expected to complete this summer if it can get past the FTC’s shieldwall. This essentially means that the company’s investor announcements are now basically just press releases with no analyst interrogation, unfortunately, hence all the hand-waving about bookings instead of revenue this round.

Here’s the full recap since 2015:

As longtime readers surely know, Activision-Blizzard, its leadership, and its games have been the subject of much-deserved criticism and scrutiny the last few years following an absolutely absurd list of scandals, including multiple rounds of mass layoffs, the Blitzchung boycott, C-suite payouts, shady stock deals/votes, abusive compensation, labor uprisings, a mass exodus of devs, plummeting playerbases, falling revenues, the ongoing sexual discrimination/harassment lawsuit, federal investigations, fired execs, destruction of evidence, workplace mismanagement, the strike, unionization attempts, unionbusting efforts, allegations against Bobby Kotick, stock drops, and the Microsoft buyout. On the gaming side, we’ve seen pipeline struggles, canceled BlizzCons, missed cadences, major delays and scope reduction, and of course the massive uproar over Diablo Immortal’s grotesque monetization. As of early 2023, Blizzard itself shuttered all but one of its MMOs in China following a painfully public contract dispute with long-time partner NetEase.