Activision-Blizzard has once again released its Q2 financials early as of this morning, but given the fact that this week was meant to be the original deadline for its merger into Microsoft, you can probably guess the reason here. Let’s dig into Q2’s results, comprising April, May, and June 2023, first with ABK and then with Blizzard itself.

Activision-Blizzard on the whole

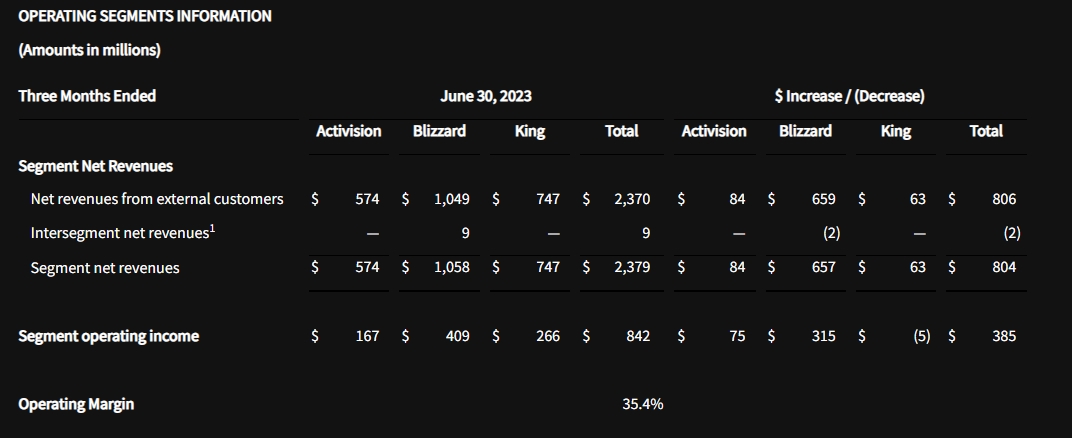

Activision-Blizzard on the whole saw a huge jump in revenue compared to Q2 2022 – a 50% increase over that comparable quarter – but a slide downward since Q1 of this year. A lot of that boost came from Blizzard, as we’ll shortly see.

“For the quarter ended June 30, 2023, Activision Blizzard’s net revenues presented in accordance with GAAP were $2.21 billion, as compared with $1.64 billion for the second quarter of 2022. GAAP net revenues from digital channels were $2.01 billion. GAAP operating margin was 26%. GAAP earnings per diluted share was $0.74, as compared with $0.36 for the second quarter of 2022. On a non-GAAP basis, Activision Blizzard’s operating margin was 32% and earnings per diluted share was $0.91, as compared with $0.48 for the second quarter of 2022..”

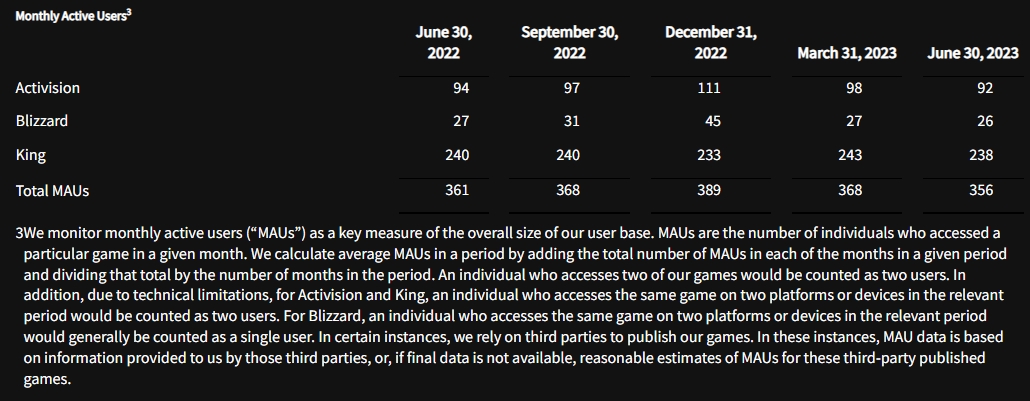

Overall ABK MAUs (monthly active users) decreased again, this time from 368M to 356M since Q1, even further off the pre-Christmas peak of 389M; Activision’s growth was credited to (as usual) Call of Duty. Activision’s own separate MAUs are also down another 2M and 13M since Q2 2022 and Q1 2023, respectively. King (the K in ABK) saw revenue up another 9% compared this this quarter last year, but it lost 2M net players over the last year.

ABK Q1-23: $2.38B

ABK Q4-22: $2.33B

ABK Q3-22: $1.78B

ABK Q2-22: $1.64B

ABK Q1-22: $1.77B

ABK Q4-21: $2.16B

ABK Q3-21: $2.07B

ABK Q2-21: $2.30B

ABK Q1-21: $2.28B

ABK Q4-20: $2.41B

ABK 2021: $8.80B

ABK 2020: $8.09B

Blizzard Q1-23: $443M

Blizzard Q4-22: $794M

Blizzard Q3-22: $543M

Blizzard Q2-22: $401M

Blizzard Q1-22: $274M

Blizzard Q4-21: $419M

Blizzard Q3-21: $493M

Blizzard Q2-21: $433M

Blizzard Q1-21: $483M

Blizzard Q4-20: $579M

Blizzard 2021: $1.827B

Blizzard 2020: $1.905B

Blizz MAUs Q1-23: 27M

Blizz MAUs Q4-22: 45M

Blizz MAUs Q3-22: 31M

Blizz MAUs Q2-22: 27M

Blizz MAUs Q1-22: 22M

Blizz MAUs Q4-21: 24M

Blizz MAUs Q3-21: 26M

Blizz MAUS Q2-21: 26M

Blizz MAUs Q1-21: 27M

Blizz MAUs Q4-20: 29M

Blizz MAUs Q1-19: 32M

Blizz MAUs Q1-18: 38M

Blizzard Entertainment by itself

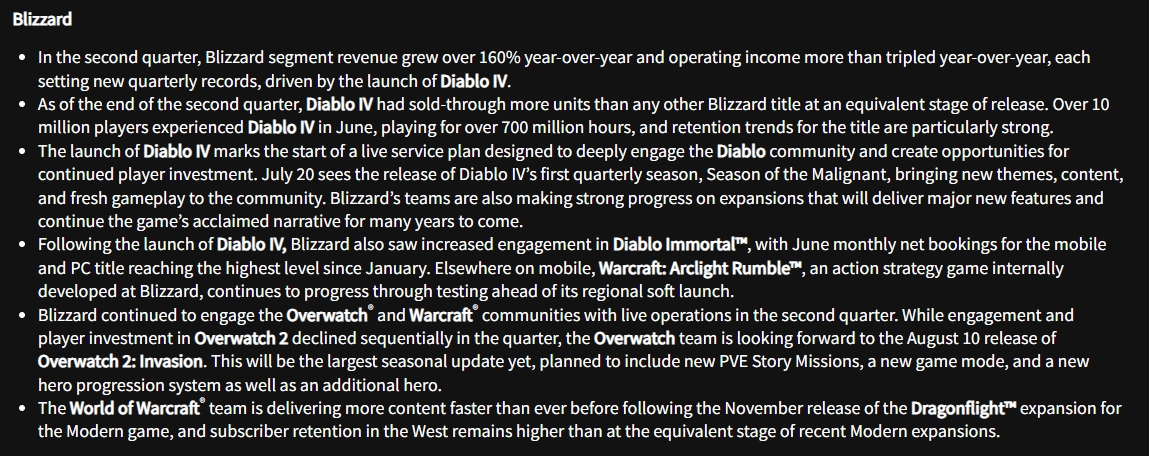

Blizzard had a truly zesty quarter owing almost entirely to Diablo IV, as expected. The company crows about 10M players for the premium title, and it drove the segment to record revenues of $1.058B – more than double its haul in Q1 or in Q2 2022 and triple its six month revenue figures.

World of Warcraft is once again barely mentioned in the report; the script repeats the tired refrain that “subscriber retention in the west is higher than at the equivalent stage of recent Modern expansions” – that caveat needed because the Chinese version was killed in January and actual MAUs and revenues seemingly continue to fall. ABK also admits that Overwatch 2 is “declining sequentially,” which was already obvious last quarter.

That brings us to the subject of MAUs, which continues to be puzzling for Blizzard right now. In Q4 of 2022, Blizzard had soared to 45M, the highest player population the company had counted since 2018, when it first began reporting company-wide MAUs. At the time, we noted that ABK had buried the news, likely because it already knew Overwatch 2 was bleeding players, an assumption now backed up by admission in this report. So MAUs fell in Q1, and now, in spite of that huge Diablo IV revenue haul, they’ve fallen again in Q2, now to 26M – lending more weight to the theory that Blizzard is keen on making more money from fewer people.

Our running MAU tally:

38M in Q1 2018

37M in Q2 2018

37M in Q3 2018 (BFA)

35M in Q4 2018 (mass layoffs)

32M in Q1 2019

32M in Q2 2019

33M in Q3 2019 (WoW Classic)

32M in Q4 2019 (Blitzchung)

32M in Q1 2020 (COVID-19)

32M in Q2 2020 (COVID-19)

30M in Q3 2020 (COVID-19)

29M in Q4 2020 (COVID-19, Shadowlands)

27M in Q1 2021

26M in Q2 2021 (TBC Classic, WoW 9.1)

26M in Q3 2021 (D2R, lawsuits)

24M in Q4 2021 (Lawsuits, drought)

22M in Q1 2022 (Lawsuits, drought)

27M in Q2 2022 (Diablo Immortal)

31M in Q3 2022 (DI China, Wrath Classic)

45M in Q4 2022 (Overwatch 2, Dragonflight)

27M in Q1 2023

26M in Q2 2023 (Diablo IV)

As always, we note here that Blizzard intentionally reports MAUs this way to obfuscate which games are gaining and losing players, and traditionally it notes whenever a specific game has increased in MAUs.

The buyout

Activision-Blizzard hasn’t been “hosting a conference call, issuing an earnings presentation, or providing financial guidance” pending the Microsoft buyout. This essentially means that the company’s investor announcements are now basically just press releases with no analyst interrogation. Worth noting is that the company announced that its merger agreement with Microsoft has indeed been extended to October 18th as expected, following Microsoft’s victory in the US courts and the apparent willingness of the UK to return to negotiations.

“Merger Agreement with Microsoft Extended to October 18, 2023 In Return for Higher Termination Fee.”

here's Xbox chief Phil Spencer's email to Microsoft employees about the Activision Blizzard deal extension https://t.co/6TOHZJfOwn pic.twitter.com/I9mdxgjORY

— Tom Warren (@tomwarren) July 19, 2023

Here’s the full recap since 2015:

As longtime readers surely know, Activision-Blizzard, its leadership, and its games have been the subject of much-deserved criticism and scrutiny the last few years following an absolutely absurd list of scandals, including multiple rounds of mass layoffs, the Blitzchung boycott, C-suite payouts, shady stock deals/votes, abusive compensation, labor uprisings, a mass exodus of devs, plummeting playerbases, falling revenues, the ongoing sexual discrimination/harassment lawsuits, federal investigations, fired execs, destruction of evidence, workplace mismanagement, the strike, unionization attempts, unionbusting efforts, allegations against Bobby Kotick, stock drops, management failures, and the Microsoft buyout. On the gaming side, we’ve seen pipeline struggles, canceled BlizzCons, missed cadences, major delays and scope reduction, and of course the massive uproar over Diablo Immortal’s grotesque monetization. As of early 2023, Blizzard itself shuttered all but one of its MMOs in China following a painfully public contract dispute with long-time partner NetEase.