Welcome back to our regular coverage of Activision-Blizzard’s quarterly financials. As readers are aware, the company, its leadership, and its games have been the subject of much-deserved criticism and scrutiny the last few years following multiple rounds of mass layoffs even in 2021, the Blitzchung boycott, exorbitant C-suite payouts, shady stock deals and votes, rejected diversity proposals, abusive compensation, labor uprisings, a mass exodus of veteran developers, plummeting playerbases, over a year of plunging YOY revenues before COVID, the ongoing sexual discrimination/harassment lawsuit, federal lawsuits and investigations, executives ousted, alleged destruction of evidence, key leaders exposing workplace mismanagement, the strike, unionization attempts and unionbusting efforts, and credible allegations against Bobby Kotick himself that led to calls for his removal and stock falling to a five-year low, which Activision blamed on Blizzard’s delays but actually began during the scandal months beforehand. For MMO players, we’re dealing with pipeline struggles, missing BlizzCon, and the fact that Blizzard missed WoW’s two-year expansion cadence for the first time ever, as well as delayed Overwatch 2 and Diablo IV.

Every quarter this list gets longer, and most recently it’s been compounded by the announcement that Microsoft is buying Activision-Blizzard for $68.7B and will keep Kotick around until at least mid-2023. That news also prompted a major stock rebound.

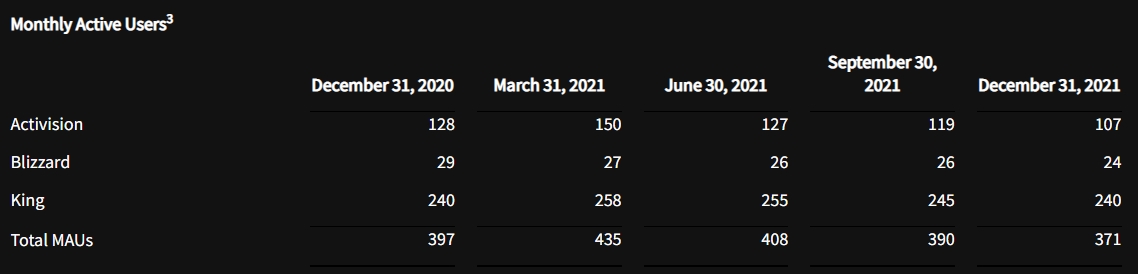

As of this afternoon, we have Q4’s results, comprising October, November, and December 2021. Activision-Blizzard on the whole saw a small increase in since last quarter but a small decrease compared to Q4 2020, while the year is up slightly over 2020 on the whole. Basically, the company is more or less holding even and is up for the full year.

“For the year ended December 31, 2021, Activision Blizzard’s net revenues presented in accordance with GAAP were $8.80 billion, as compared with $8.09 billion for 2020. GAAP net revenues from digital channels were $7.66 billion. GAAP operating margin was 37%. GAAP earnings per diluted share was $3.44, as compared with $2.82 for 2020. On a non-GAAP basis, Activision Blizzard’s operating margin was 44% and earnings per diluted share was $4.08, as compared with $3.21 for 2020.

“For the quarter ended December 31, 2021, Activision Blizzard’s net revenues presented in accordance with GAAP were $2.16 billion, as compared with $2.41 billion for the fourth quarter of 2020. GAAP net revenues from digital channels were $1.78 billion. GAAP operating margin was 32%. GAAP earnings per diluted share was $0.72, as compared with $0.65 for the fourth quarter of 2020. On a non-GAAP basis, Activision Blizzard’s operating margin was 45% and earnings per diluted share was $1.01, as compared with $0.76 for the fourth quarter of 2020.

“Activision Blizzard generated $2.41 billion in operating cash flow for the year ended December 31, 2021, as compared with $2.25 billion for 2020. For the quarter, operating cash flow was $661 million, as compared with $1.14 billion for the fourth quarter of 2020.”

ABK Q3-21: $2.07B

ABK Q4-20: $2.41B

ABK 2021: $8.80B

ABK 2020: $8.09B

Blizzard Q3-21: $493M

Blizzard Q4-20: $579M

Blizzard 2021: $1.827B

Blizzard 2020: $1.905B

Blizz MAUs Q3-21: 26M

Blizz MAUs Q4-20: 29M

Blizz MAUs Q1-19: 32M

Blizz MAUs Q1-18: 38M

“Within the Warcraft franchise, fourth quarter World of Warcraft reach and engagement continued to benefit from the combination of the Modern game and Classic under a single subscription. In 2021, World of Warcraft delivered its strongest engagement and net bookings outside of a Modern expansion year in a decade. Hearthstone fourth quarter net bookings grew year-over-year, driven by a steady cadence of new content. Blizzard is planning substantial new content for the Warcraft franchise in 2022, including new experiences in World of Warcraft and Hearthstone, and getting all-new mobile Warcraft content into players’ hands for the first time. Hearthstone fourth quarter net bookings grew year-over-year, driven by a steady cadence of new content. Blizzard is planning substantial new content for the Warcraft franchise in 2022, including new experiences in World of Warcraft and Hearthstone, and getting all-new mobile Warcraft content into players’ hands for the first time. In the Diablo franchise, Diablo II: ResurrectedTM sold through more units from its September release until the year end than any other Activision Blizzard remaster over an equivalent period. On mobile, Diablo Immortal concluded its public testing with positive feedback. Blizzard is making strong progress on its pipeline, including new experiences in Warcraft, ongoing development in Diablo and Overwatch, and an exciting new IP.”

Blizzard Q4 2021 revenue all by itself was $419M, a decrease of $74M compared to Q3 2021 and a decrease of $160M compared to Q4 2020 as well. Blizzard’s 2021 revenues are down $78M when compared to the whole of 2020.

Unfortunately, Blizzard lost another 2M monthly active users (MAUs) over the quarter, meaning it’s now lost 14M players, approximately 36.8% of its playerbase, over the last four years. Last quarter, MAUs had held steady at 26M, apparently owing to Diablo 2 Resurrected’s success in South Korea, but it doesn’t appear that’s held up. Activision and King MAUs also fell over the period.

As always, we note here that Blizzard intentionally reports MAUs this way to obfuscate which games are gaining and losing players. However, Blizzard is usually happy to declare it when a game has increased in MAUs, something it did not do for Q3 or Q4, so we are left to assume some of those lost players are from WoW.

38M in Q1 2018

37M in Q2 2018

37M in Q3 2018 (BFA)

35M in Q4 2018 (mass layoffs)

32M in Q1 2019

32M in Q2 2019

33M in Q3 2019 (WoW Classic)

32M in Q4 2019 (Blitzchung)

32M in Q1 2020 (COVID-19)

32M in Q2 2020 (COVID-19)

30M in Q3 2020 (COVID-19)

29M in Q4 2020 (COVID-19, Shadowlands)

27M in Q1 2021

26M in Q2 2021 (TBC Classic, WoW 9.1)

26M in Q3 2021 (D2R, lawsuits)

24M in Q4 2021 (Lawsuits, drought)

There’s no conference call today, as Activision-Blizzard previously declared it will “not be hosting a conference call, issuing an earnings presentation, or providing financial guidance” pending the Microsoft buyout. Here’s the full recap since 2015: