Enad Global 7’s Q4 2022 investor report dropped over the weekend, with a recap of the year for Swedish games corp EG7 and its subsidiary Daybreak Game Studio, which is basically running the whole show since the 2021 ouster of CEO Robin Flodin. Daybreak’s Ji Ham has been Acting CEO ever since.

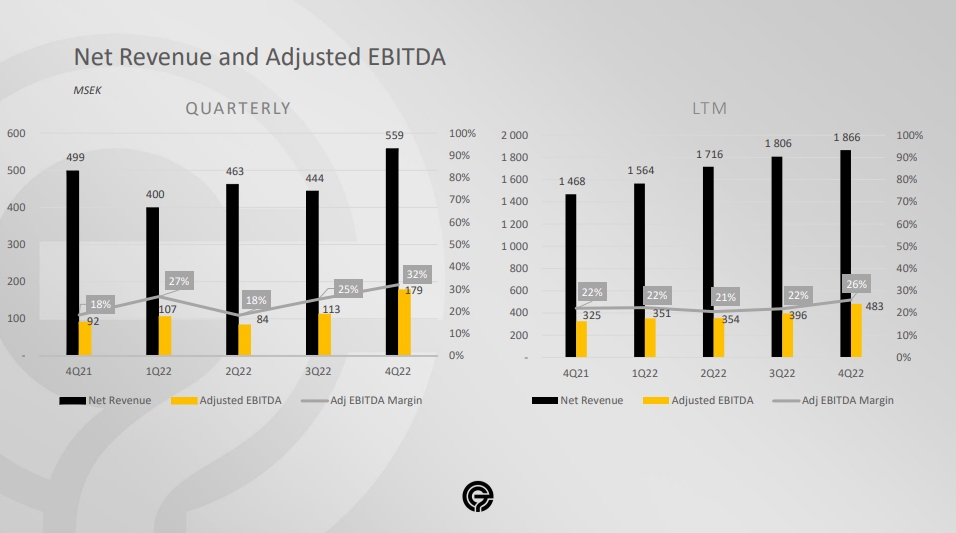

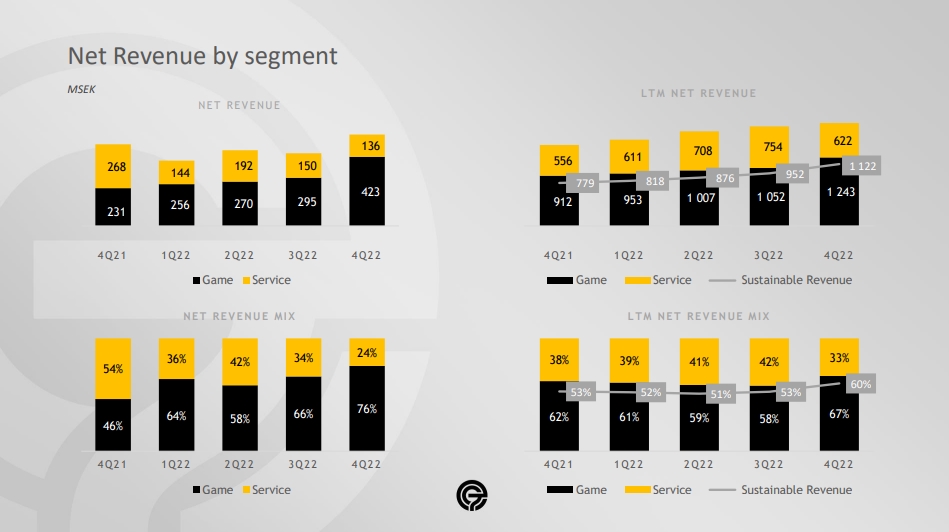

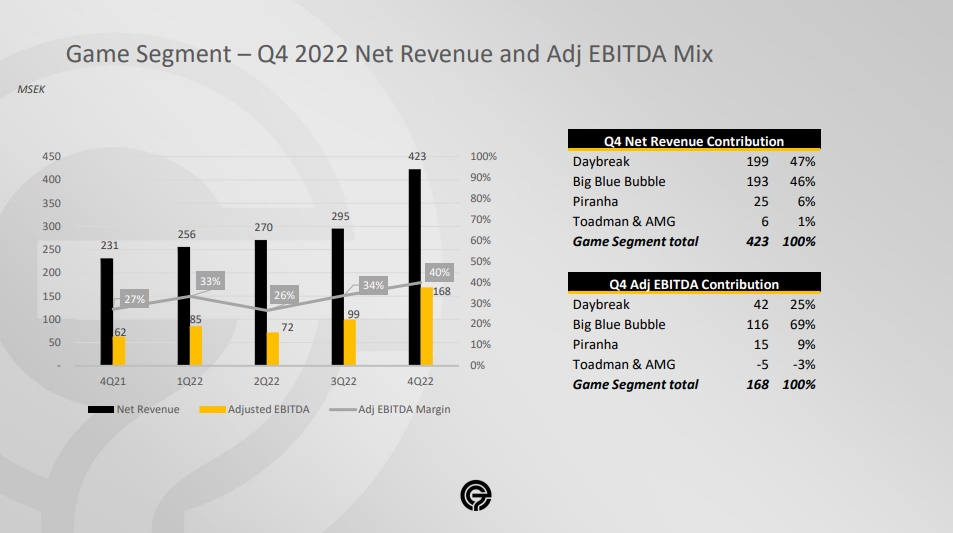

There are no major surprises in the numbers here; in Q4, the company pulled in 559M SEK (about $54M US), a rise of 12% over Q4 2021. For 2022 on the whole, revenues were 1.865B SEK ($183M US), a rise of 27.1% when compared to 2021. That’s actually understating things a bit; readers will recall that 2021 was a gigantic year for EG7 and saw revenues rise over 150% over 2020. So while growth has slowed down, it’s still climbing, and this quarter, it’s apparently because of Big Blue Bubble’s viral mobile hit My Singing Monsters.

What about the rest of the company in Q4? Daybreak (which contributes nearly half of the company’s game segment revenues) and other business units “performed in line with expectations, experiencing modest declines in performance due to the unfavorable comparison to the prior year’s pandemic-boosted results,” Ham says.

“For Q4 2022, Daybreak contributed Net Revenue of SEK 198.9 (172.4) million [Eds. note: That’s around $19M US for Q4], corresponding to 15.3 percent growth and Adjusted EBITDA amounted to SEK 41.7 (51.5) million. Adjusted EBITDA margin amounted to 20.9 (29.9) percent. The unfavorable comparison against the pandemic boosted result in 2021 remained throughout the quarter. The growth YoY was largely driven by Magic Online and the favorable currency movement. In Q4, Magic Online was successfully transitioned to Daybreak’s platform infrastructure to help ensure long-term growth and continued service for the game’s many fans. Daybreak results represented the largest Net Revenue contribution amongst the group companies with a contribution of 35.6 percent and the second largest Adjusted EBITDA contribution of 23.3 percent for the period.”

In the investor presentation, Ham references the “Russia-Ukraine situation” (i.e., Russia’s invasion of Ukraine, which has caused the deaths of thousands of Ukrainian civilians) as a “risk” the company had “successfully divest[ed]” (by selling Russia-based Innova).

Ham also talks up the company’s transition to a “work-for-hire” outfit, which it’s “prioritiz[ing] over first party titles under development using new unproven IPs or subscale IPs with limited audience.” The investor report discusses selling assets and publishing rights, launching games into early access, and using in-house staff to “make progress on the WIP titles for potential sale/release.”

It doesn’t sound as if any of the core studios is at risk here, as the report talks up the IPs behind EverQuest, DC Universe Online, Lord of the Rings Online, Dungeons and Dragons Online, Magic the Gathering Online, and H1Z1. No, that’s not a joke. “H1Z1, the very first battle royale game that was credited as one of the inspirations for Fortnite, with over 40 million life-to-date (LTD) registrations,” EG7 says, as if the franchise hasn’t been utterly abandoned and players left to rot.

The company does single out LOTRO and DDO’s transmedia synergy boosts:

“The Lord of the Rings, arguably the most iconic classic fantasy IP, which has experienced mainstream resurgence with the highly appreciated Amazon series that premiered in September 2022. Dungeons & Dragons, with a passionate fan base world-wide, poised for further global brand expansion with the new feature film Dungeons & Dragons: Honor Among Thieves expected to release in spring 2023.”