It’s not even been two weeks since Daybreak owner EG7 published its 2023 annual financial report, which of course omitted everything relevant that happened in Q1 of this year – including the sale of the PlanetSide IP and the transfer of the PlanetSide 2 development out of Daybreak to Toadman. So surely, in its Q1 presentation, EG7 is finally being more forthcoming about what’s going on? Well, no.

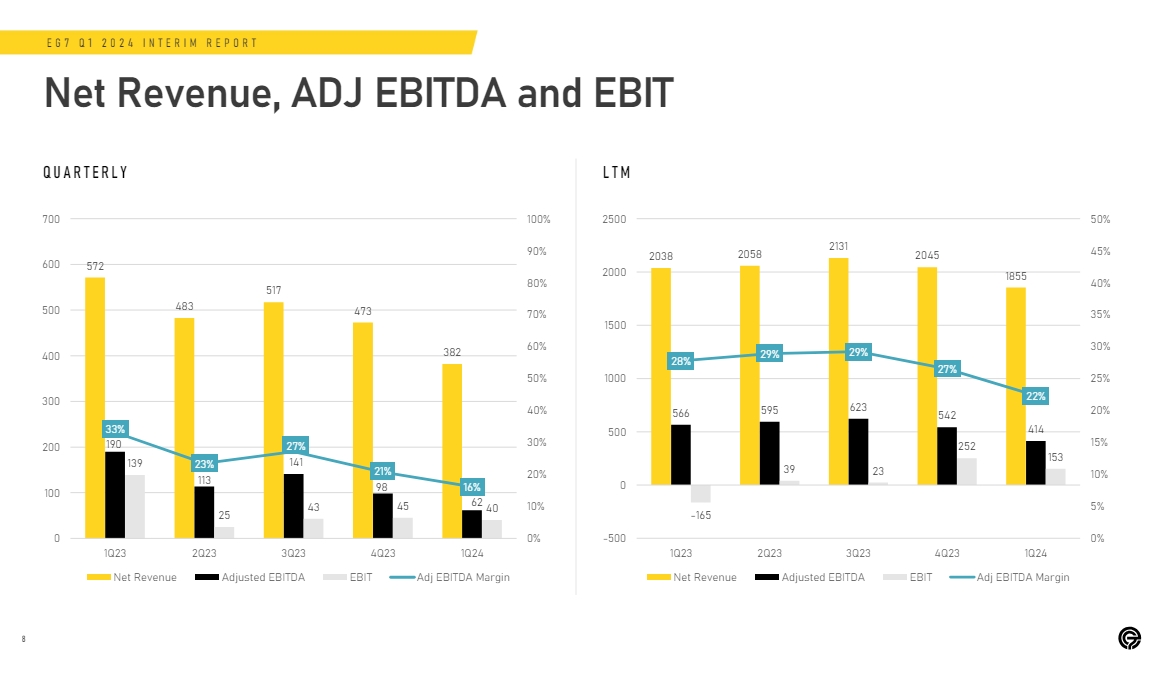

The Q1 2024 financial report calls this a “quiet quarter as expected” owing to “no major content releases this period” – and no boost from cash-cow My Singing Monsters, either. The company admits that its revenues for Q1 were down 16% (382M SEK/36M US) but suggests that a straightforward comparison to Q1 2023 is not “appropriate” given the pipeline and industry trends.

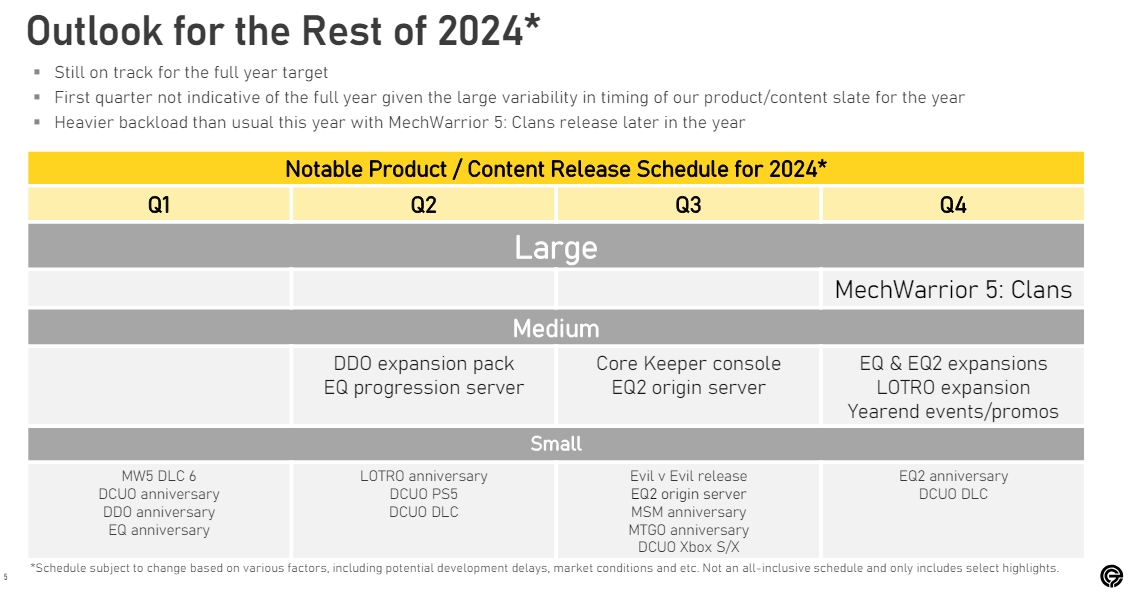

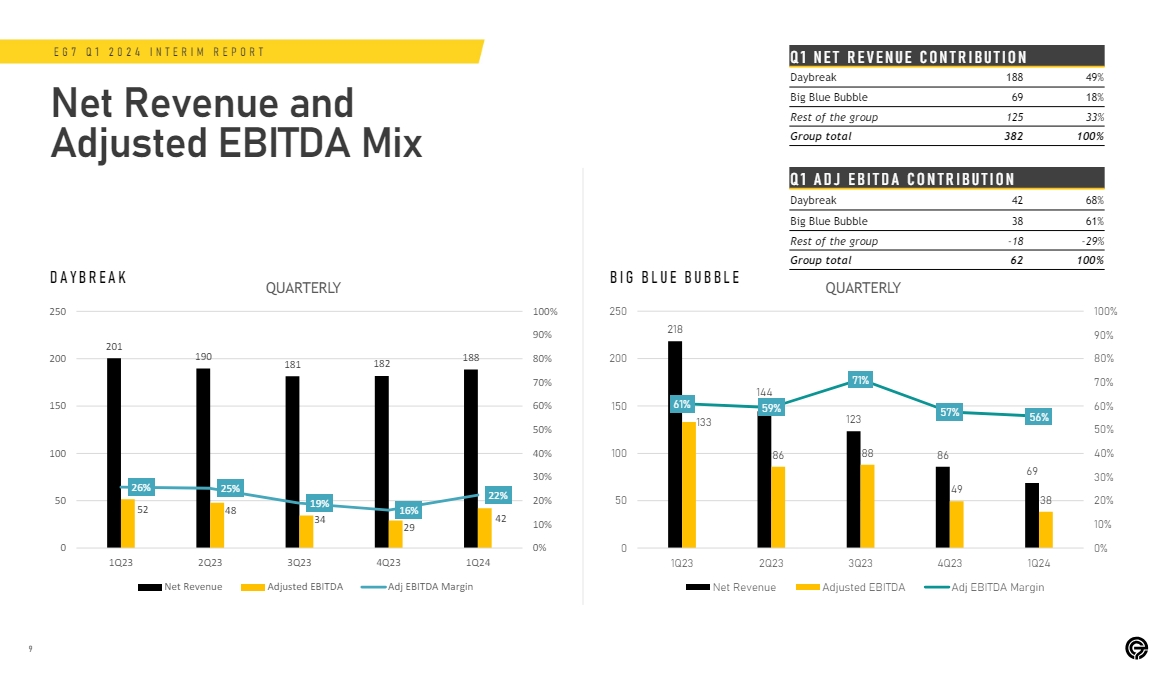

EG7 does argue that “market weakness [is] not impacting [its] live service games in a meaningful way” and says that Daybreak, which in Q1 delivered 49% of the company’s revenues (188M SEK/18M US), is “performing as expected” with “large product releases weighted towards the backend of the year.” The investor presentation includes a slide touting new content for a ton of EG7’s games – chiefly Daybreak, of course, and mostly stuff we knew about – with the DDO expansion in Q2, the planned EverQuest and EverQuest II progression servers, two DCUO updates and the Xbox S/X release, and of course, the general trio of end-of-year expansions for Lord of the Rings Online, EQ, and EQII. While it does obliquely refer to the sale of PlanetSide, it continues to call it a “non-core IP” and does not mention the game or IP at all, even though the whole thing has been common knowledge for months and the studios have announced it to players.

“For Q1, Daybreak contributed Net Revenue of SEK 188.5 (200.6) million, down 6.1 percent from the prior year, and Adjusted EBITDA of SEK 42.1 (51.6) million. Adjusted EBITDA margin amounted to 22.4 (25.7) percent. The performance for the quarter was in line with expectations and we predict a stable performance from here on and throughout the year on the back of EverQuest’s anniversary year which kicked off with events and giveaways during the period, showing a nice uptick in player activity. 2Q will see the launch of the progression servers, which is EverQuest’s second largest expansion for the year, bringing back much of the games nostalgia. Together with the launch of DC Universe Online on the latest generation of console the studio also strengthened its management team during the period. On the investment front, Daybreaks collaboration with Cold Iron is on track for mid-2025 launch with new positive feedback from the third-party advisors and quality testers. During the period Daybreak successfully closed on the sale of a non-core IP for USD 5.9 million, resulting in a nice boost in liquidity and a profit compared to the book value of the asset.”

Perhaps PlanetSide 2’s transition from Daybreak to Toadman is listed under Toadman? Nope. In fact, Toadman apparently saw layoffs of 35 people in April. In the accompanying memo, Acting CEO Ji Ham suggests that EG7’s service units are struggling and alludes to “reductions in headcount by 45” people – i.e., layoffs. During the call, it’s made clear that Toadman’s layoffs were the majority of that 45, with others from Petrol. (Daybreak has still not clarified what’s happened to the Rogue Planet team now that PlanetSide 2 has been offloaded.)

What about the investor call itself? Friends, I sat through the whole thing listening to millionaires read a PDF to me, and nope. Deputy CEO/VP/CFO Fredrik Rüdén does recite the bit about the sale of a non-core IP to offset Canadian taxes, but clarity on PlanetSide is not in there.

During the Q&A session at the end of the call, executives did address EG7’s stock uplisting to a major exchange (still on track for 2024, no hurdles expected), expectations for competition for MechWarrior 5 Clans (launching at the end of the year), and production of the next H1Z1 title proposed last fall. Ham says the company is aiming for the AA range with a $25M US budget, but it’s too early to lock it down. However, it is indeed still only in preproduction, though Daybreak hired in a “talented lead designer” with “significant experience” in the genre. Apparently, it’ll be developed by Daybreak and external workers too.